Initial Setup of Big E-Z Books

How to set up the desktop version for the first time.

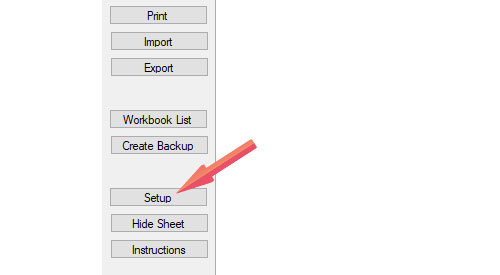

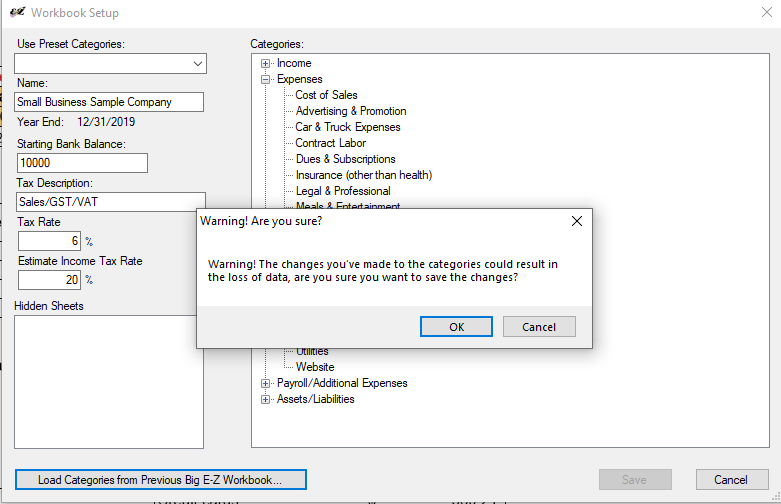

Step 1. The instruction screen in the first period should appear when you first open Big E-Z Books. Start by clicking on Setup from the left menu.

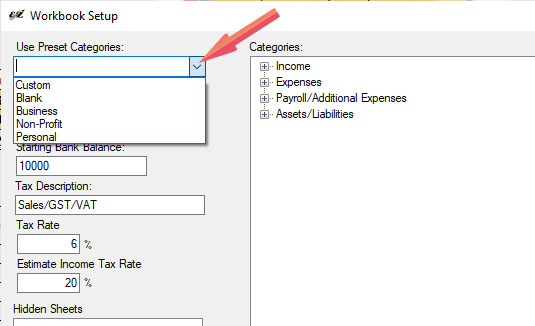

Step 2. Click on the down arrow to Use Presets (of our expense category groups) for your business, non-profit, or personal.

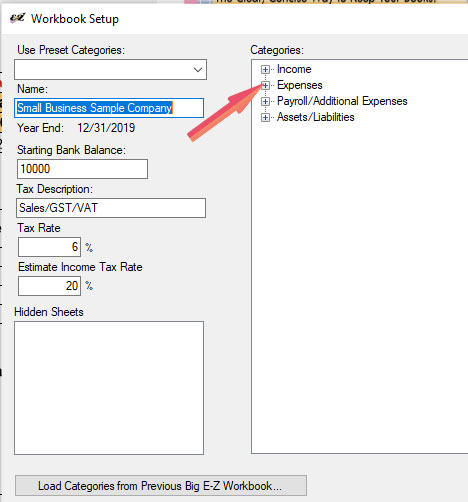

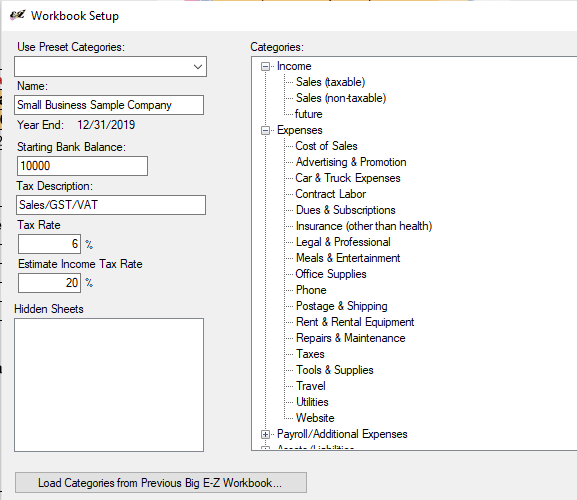

Step 3. In the Categories box, click the plus sign next to Expenses.

The list of Expense Account Categories will show up.

Step 4: Double-click on any Income or Expense category to change it.

Step 5: Click Save, OK to the warning message, and OK once again.

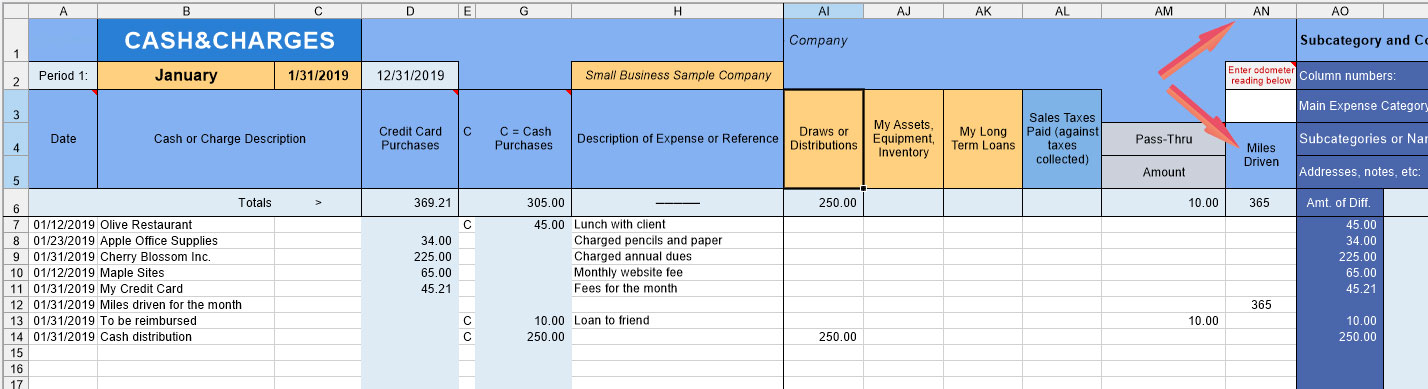

The expense categories will be listed in the Checks spreadsheet for the first period and will populate throughout all the months and all the accounting reports. Note: If you need to change any categories this can only be done in the first period. Using our preset categories to keep your records this year would give you good summary totals to use for tax time reporting.

Optional Setup

Mileage

Start tracking mileage at the beginning of the year with your Odometer reading on the first period’s Cash&Charges row 3, column AL.

Reconcile All Your Accounts

The Bank Reconciliation in Big E-Z Books will reconcile your main checkbook but use the Account Balance Tracker to reconcile monthly activity from all other accounts. It will assist you in an easy review, by account, of how money is received, expensed, or owed in other accounts such as your savings account.

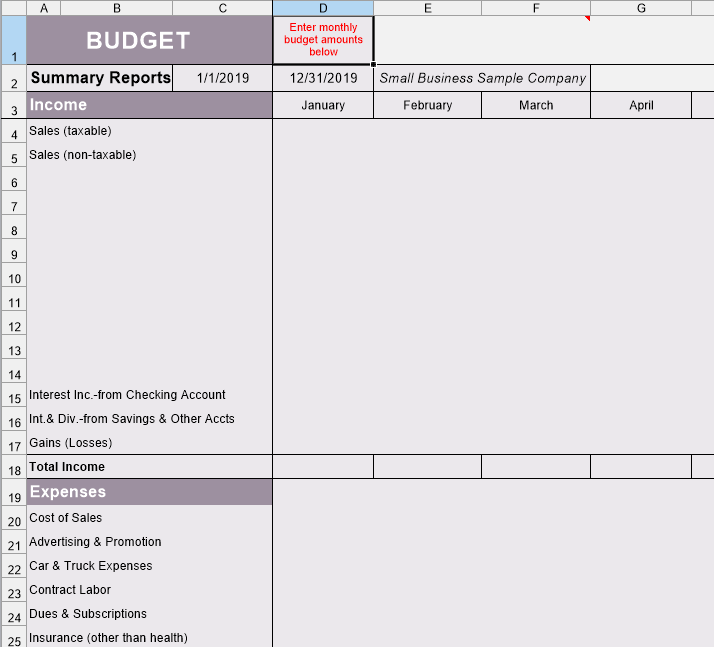

Budget

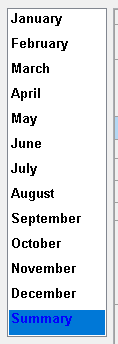

Click on Summary from the left menu.

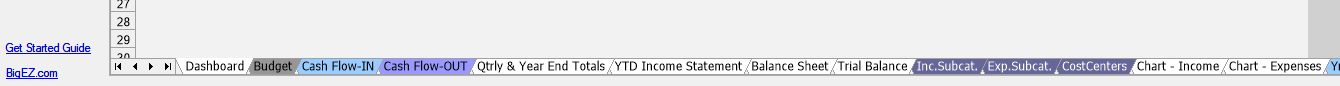

Then click on the Budget tab from the bottom menu of the Summary Reports.

Enter monthly budget amounts in column D. The budget amounts will show up on each month’s Income&Expenses report sheet as well as the YTD Income Statement.

Cost Centers and 1099 Information

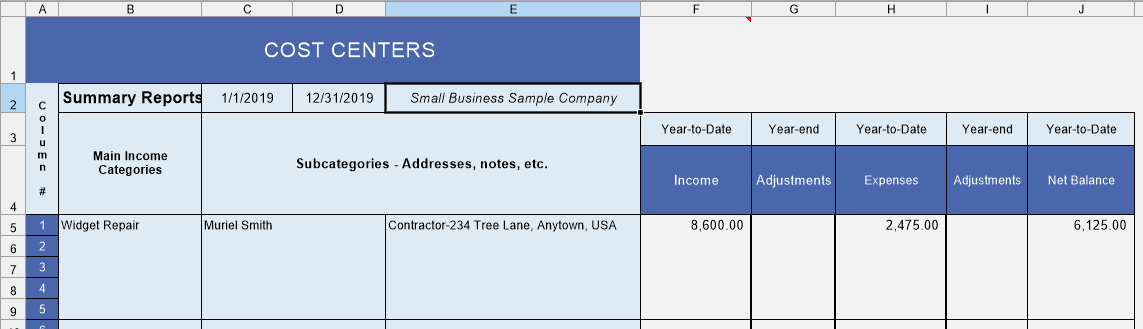

To set up a Cost Center to determine the Net Balance of certain Subcategories do the following:

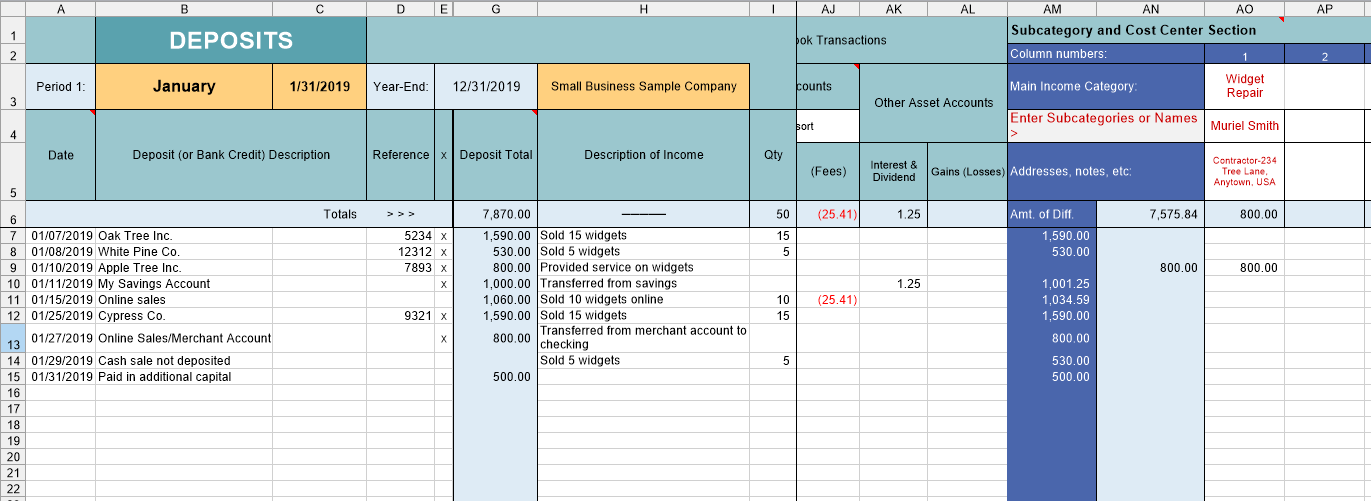

A) Click on the Deposits ledger in the first period and assign the Income Subcategory to column AO 1.

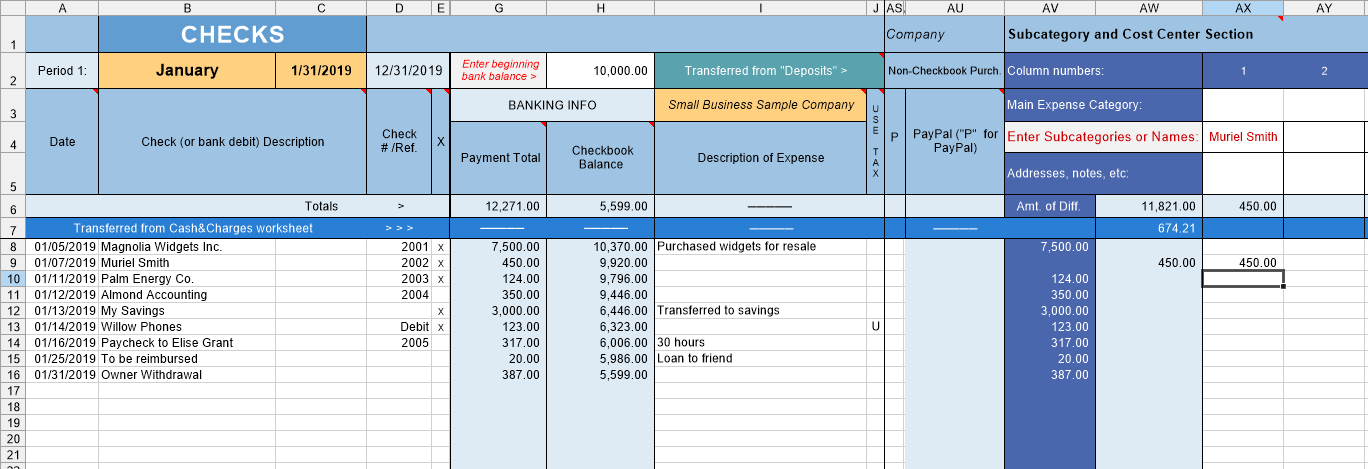

B) Click on the Checks ledger in the first period and assign the Expense Subcategory to column AX 1.

C) View the Cost Center balances by clicking on Summary then on the CostCenters tab.

The Cost Centers screen will open and you will be able to compare Year-to-Date Income vs. Year-to-Date Expenses and the Net Balance as shown below.

To set up 1099 tracking, click on Checks and scroll right to the Subcategory Section. There are 100 columns to use for 1099s or track anything you like.

To see the totals click on Summary and the Exp. Subcat. tab.