Big E-Z Books for Windows

Easy to use bookkeeping software for PCs with Windows 7 or newer that produces professional-looking reports for tax time. Simply enter your data in the columns and rows, then categorize your entries, and let Big E-Z do the rest!

$99 for an annual license that’s packed full of functionality!

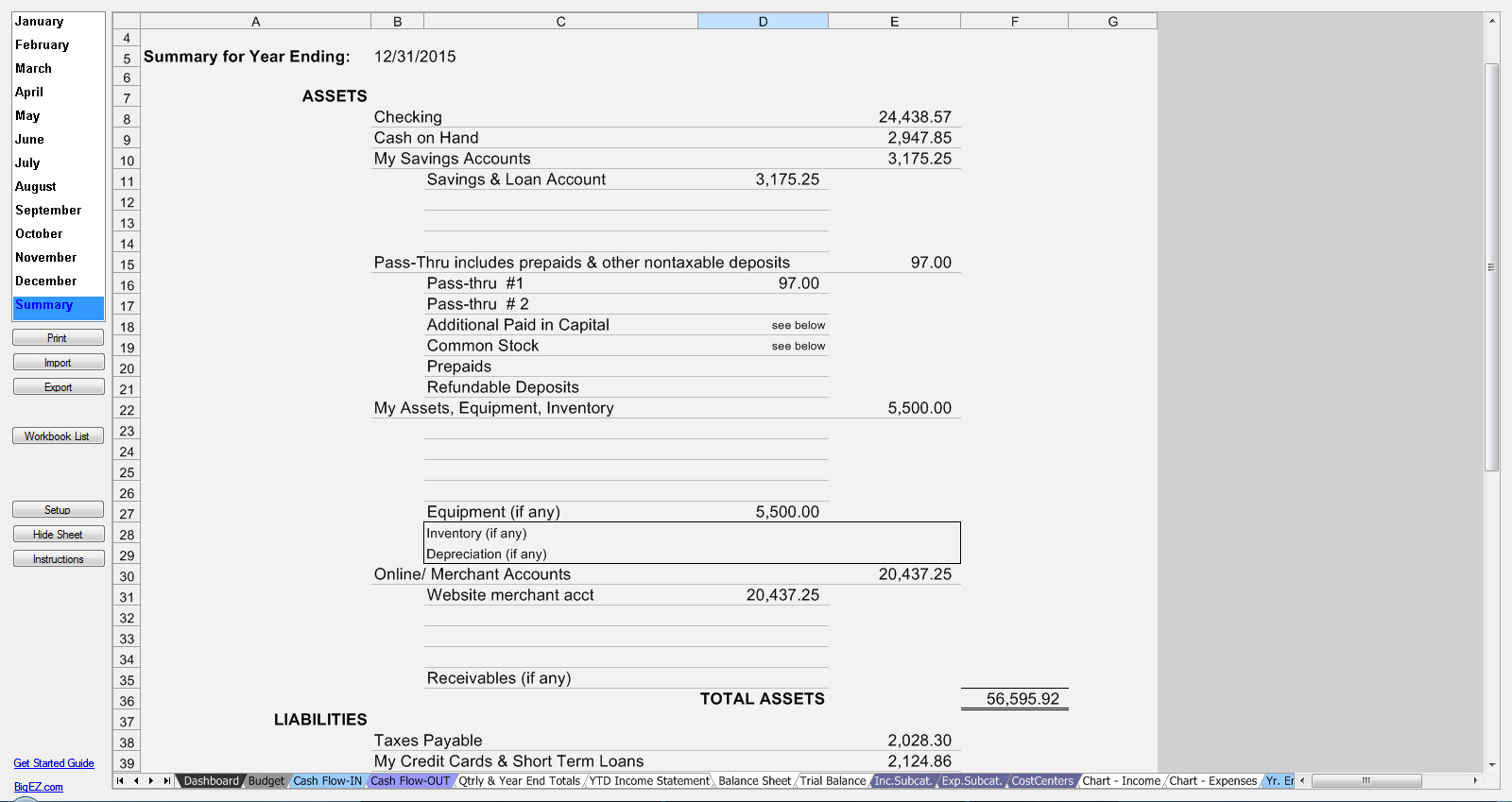

Financial Reports

Our insightful financial reports will let you instantly see where you finances stand. View the complete list of accounting reports and professional-looking financial statements Big E-Z Books will automatically generate for you.

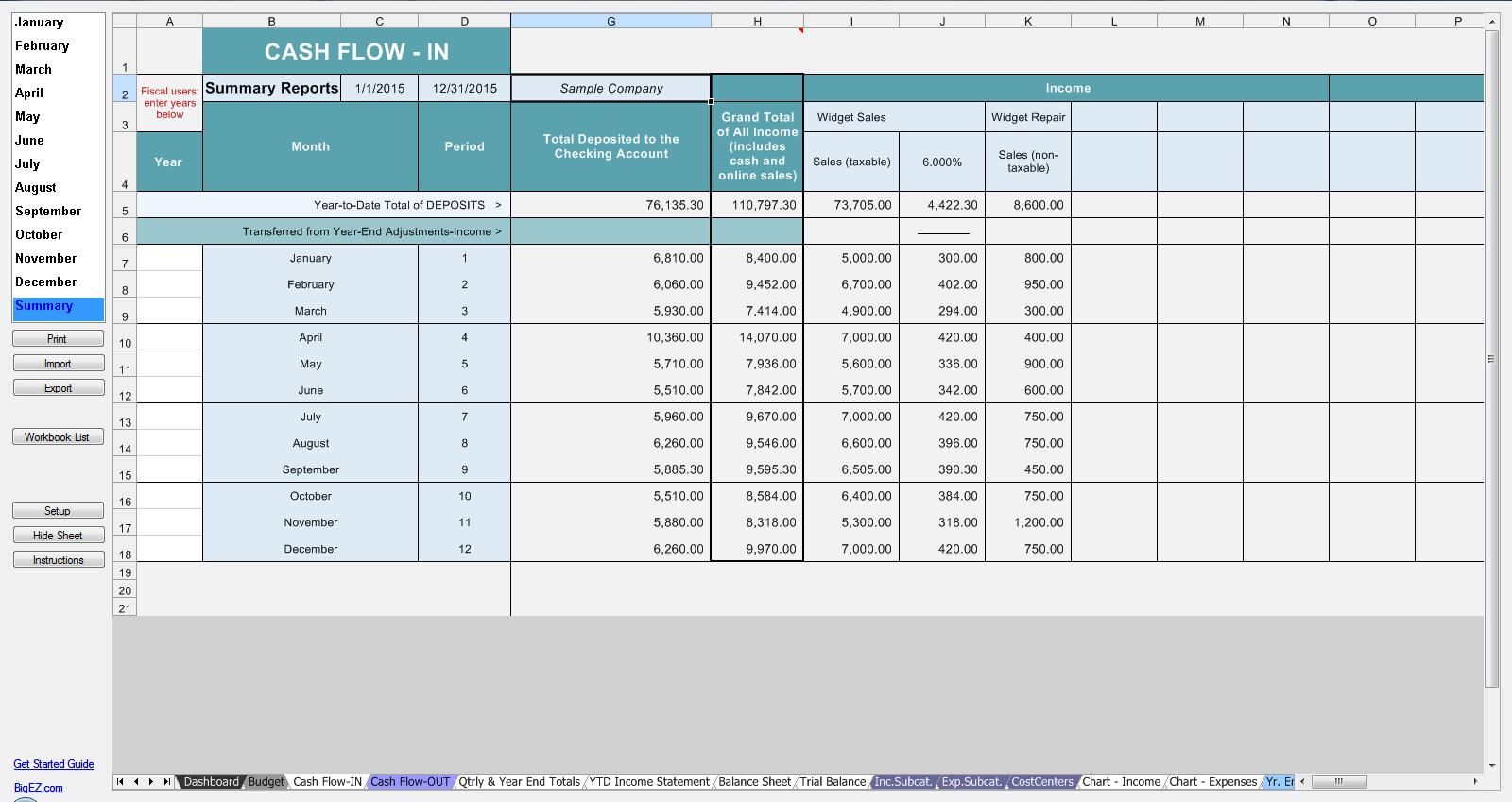

Cash Flow In Report

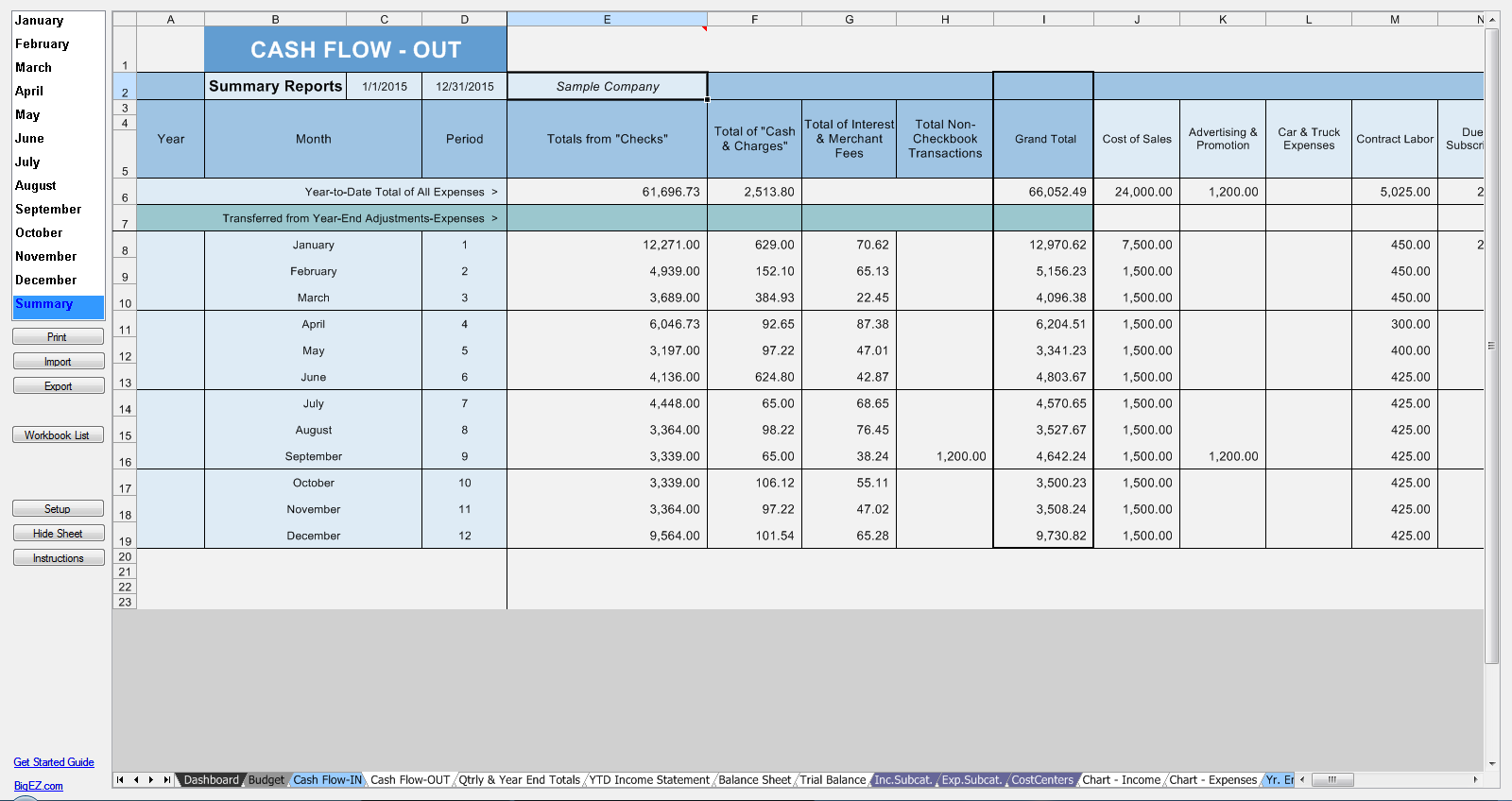

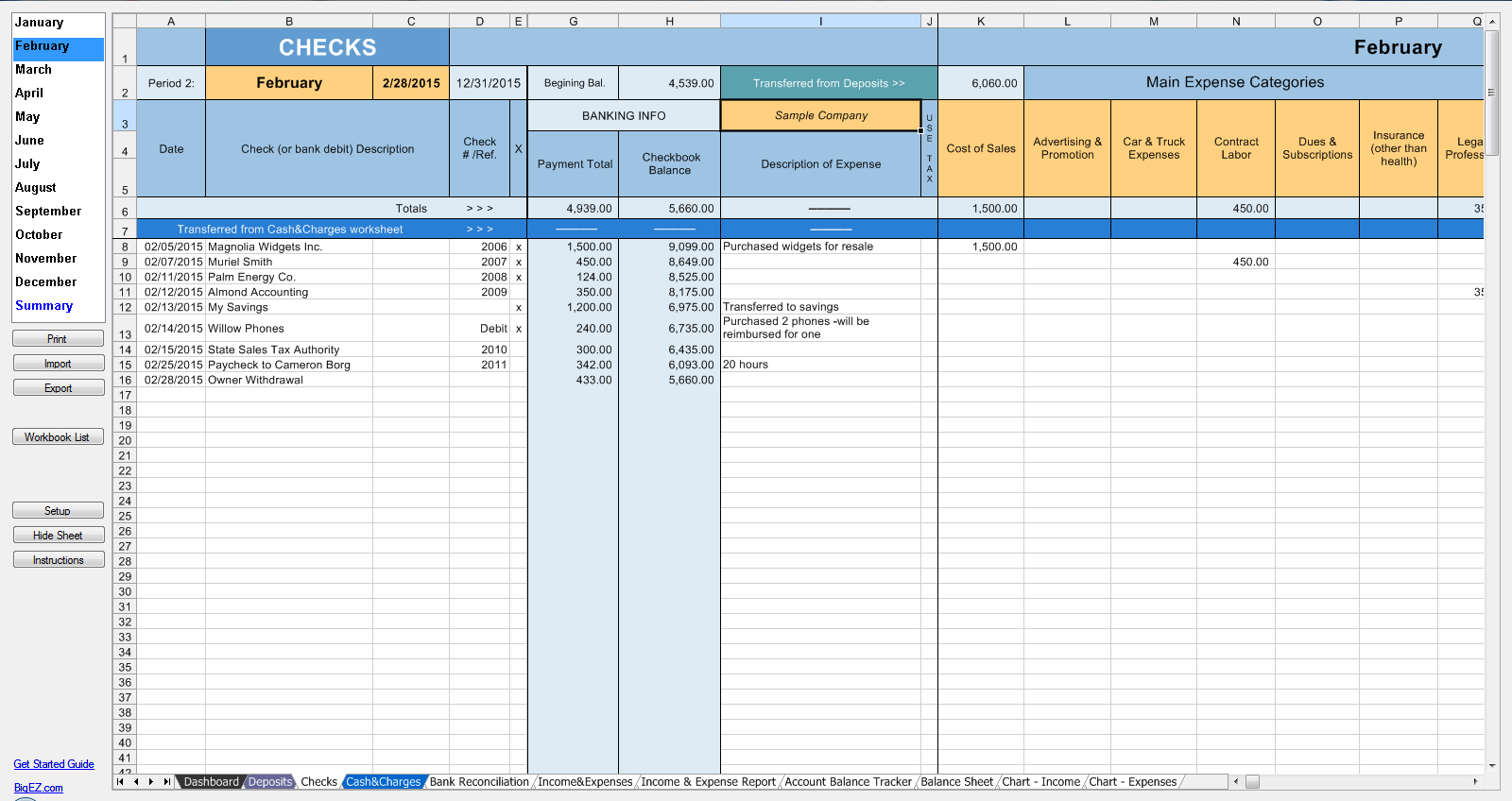

Cash Flow Out Report

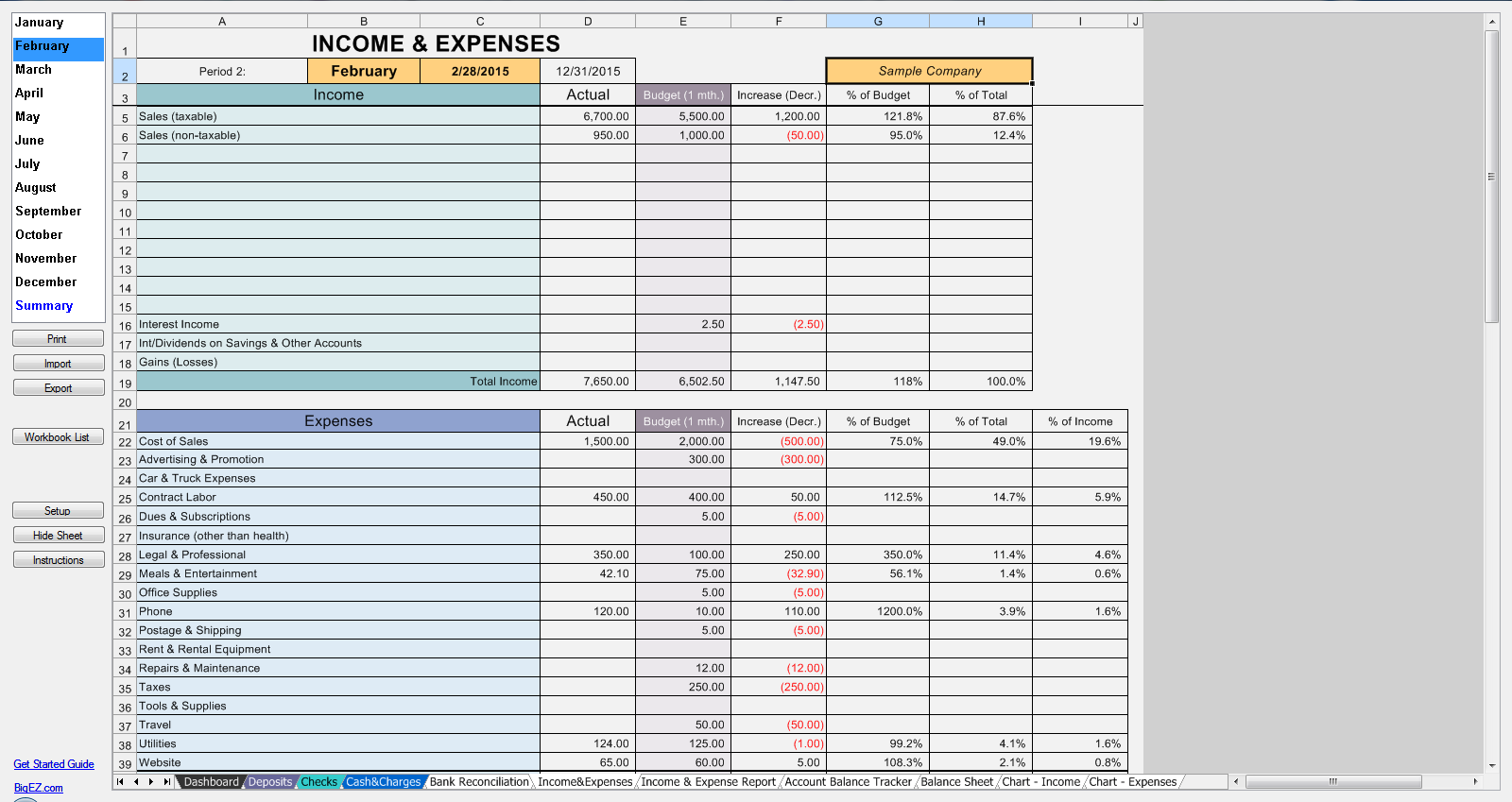

Income & Expenses With Budget Comparison

Balance Sheet

Checks Ledger Sheet

$99

Desktop Annual License

Big E-Z Books bookkeeping software requires an annual license for each year of recordkeeping.

Your annual license key unlocks:

- One workbook for one year with year-end summary reports

- Use for one entity on one computer.

- 12 months of email support from the date of purchase

- Easily install additional licenses for another entity or another year

Choose your license based on your calendar or fiscal year-end date.

Looking for an online version?

View our product comparison to see what version best fits your needs.

2024

For 2024 calendar year recordkeeping, or if you follow a fiscal year (for example, June 1, 2023 through May 31, 2024)

Purchase 2024 License →

2023

For 2023 calendar year recordkeeping, or if you follow a fiscal year (for example, June 1, 2022 through May 31, 2023)

Purchase 2023 License →

2022

For 2022 calendar year recordkeeping, or if you follow a fiscal year (for example, June 1, 2021 through May 31, 2022)

Purchase 2022 License →